40+ Mortgage debt to income ratio calculator

When determining whether to approve you for a certain mortgage amount lenders pay close attention to your debt-to-income ratio DTI. Your DTI compares your total monthly debt payments to your.

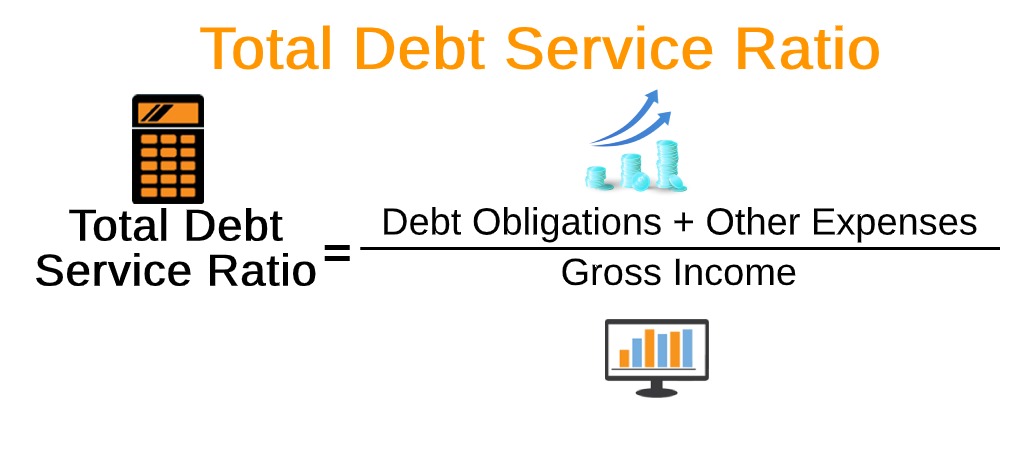

Total Debt Service Ratio Explanation And Examples With Excel Template

This shows the company has more debt funding in its capital structure.

. Chase recommends that consumers have a DTI of 40 or lower. Debt-To-Income Ratio - DTI. Enter Car Loan EMI if you dont have car loan currently give 0.

Most lenders look for a ratio of 36 or less although there are exceptions. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year. It shows your total income total debts and your debt ratio.

The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage. Check out Moneys debt-to-Income ratio calculator. Private mortgage insurance PMIprotects the mortgage lender if the borrower is unable to repay the loan.

Heres how the debt ratio is rated. Use our mortgage calculator to estimate your monthly house payment including principal and interest property taxes and insurance. This will be the only land contract calculator that you will ever need whether you want to calculate payments for residential or commercial lands.

Rocket Mortgage states that most lenders prefer consumers which have a DTI of 50 or lower when applying for. For your convenience we list current Redmond mortgage rates to help homebuyers estimate their monthly payments find local lenders. The acceptable DTI ratio will vary depending on the lender but you will typically want to stay below.

43 percent to 49 percent. Lenders calculate your debt-to-income ratio by dividing your monthly debt obligations by your pretax or gross income. 40 in London of the propertys full price.

As a requirement you must make a 5. If the company have a lower debt ratio then the company is called a Conservative company. This includes credit cards car loans utility.

Use this to figure your debt to income ratio. This percentage is then considered your debt-to-income ratio. Enter if you get any additional payments apart from the major income like salary.

A back end debt to income ratio greater than or equal to 40 is generally viewed as an indicator you are a high risk borrower. Learn about debt-to-income and use our free DTI calculator to divide your monthly income by your monthly debt payments. The following data from the Federal Reserve shows how mortgage debt has grown over time.

The debt-to-income ratio is one. In relation to a mortgage PITI pronounced like the word pity is the sum of the monthly principal interest taxes and insurance the component costs that add up to the monthly mortgage payment in most mortgages. The biggest pullback from the 2008 to 2009 global recession was in Q4 of 2010 with mortgage debt falling by 421.

To understand how debt-to-income ratio impacts mortgage approval refer to the table below. In recent years total mortgage debt has been growing at a rate of roughly 35 to 37 annually. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

However because of residual income applicants whose. Enter Mortgage Loan EMI if you dont have mortgage loan currently give 0. The Department of Veterans Affairs mortgage guidelines state that 41 is the maximum debt-to-income ratio for a military mortgage borrower.

The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall income. If a company have a Debt Ratio greater than 050 then the company is called a Leveraged Company. 50 percent or more.

28 of your income will go to your mortgage payment and 36 to all your other household debt. This ratio is known as the debt-to-income ratio and is used for all the calculations of this calculator. Under the heading Results you can see a pie chart of your debt to income ratio.

Enter your monthly income like salary business profits or etc. This presumes all other parts of your application such as income credit score and credit history have a good record. What Mortgage Can I Afford Calculator.

The debt ratio can be used as a measure of financial leverage. 37 percent to 42 percent. Conventional Loans and the 2836 Rule In the US a conventional loan is a mortgage that is not insured by the federal government directly and generally refers to a mortgage loan that follows the guidelines of government-sponsored.

36 percent or less. Most people need a mortgage to finance a home purchase. Calculate Your Debt to Income Ratio.

Specifically if the down payment is less than 20 of the propertys value the lender will normally require the borrower to purchase PMI until the loan-to-value ratio LTV reaches 80 or 78. That is PITI is the sum of the monthly loan service principal and interest plus the monthly property tax payment homeowners insurance. The 2836 rule is an addendum to the 28 rule.

Come to a total of 2000 which is then divided by your gross monthly income of 5000 which will then provide you with 40.

How Much Townhouse Can I Afford Deals 54 Off Powerofdance Com

Greg Perkins Realtor Gri On Linkedin What Do Mortgage Lenders Look For 1 Creditworthiness Including

Personal Financial Statement Personal Financial Statement Financial Statement Statement Template

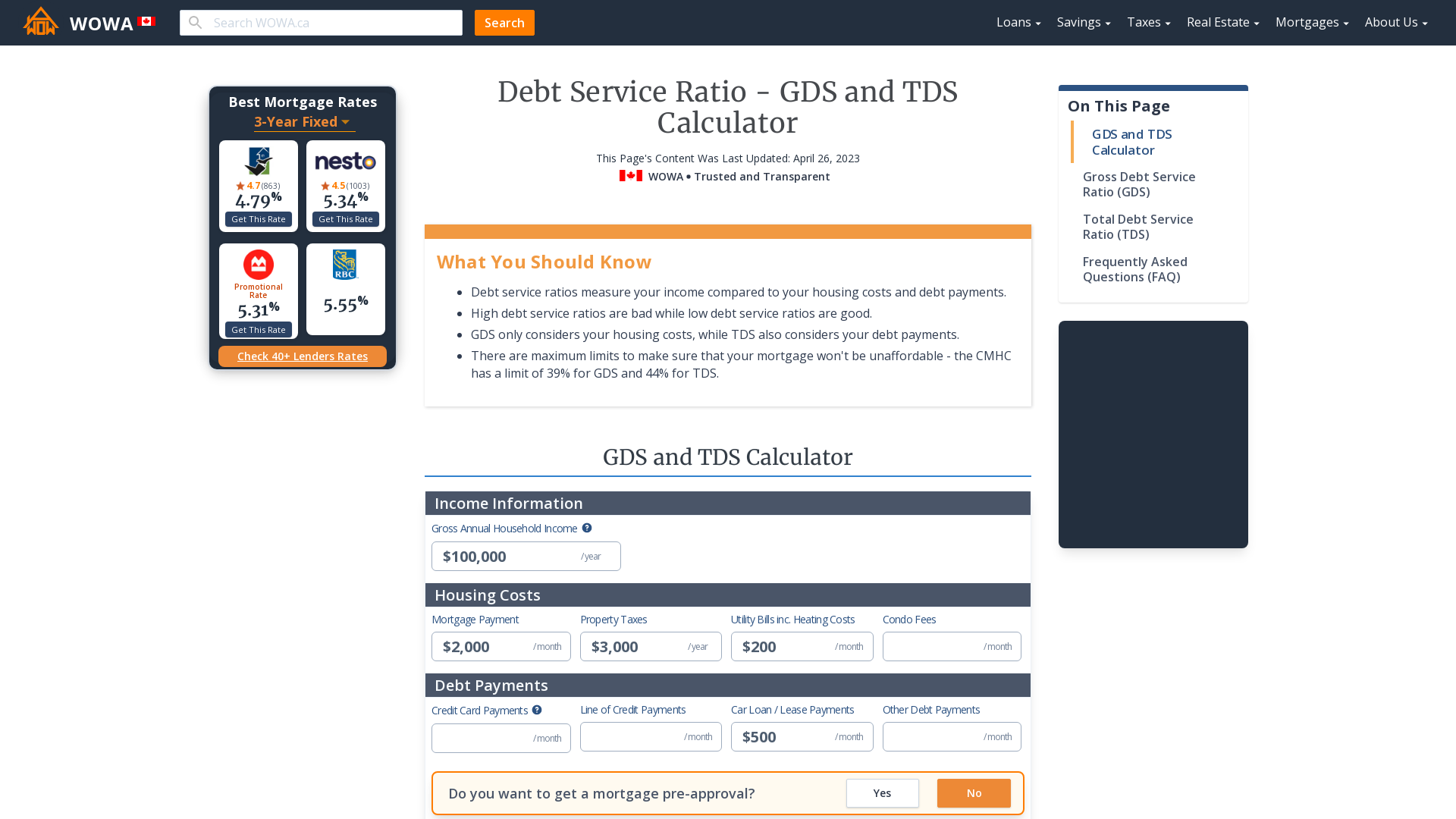

Debt Service Ratio Gds Tds Calculator Wowa Ca

How Much Should I Have Saved By 35 A Retirement Savings Guide

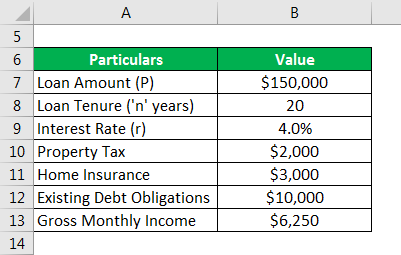

Debt Ratio Formula Calculator With Excel Template

How To Calculate Your Financial Independence Ratio

Total Debt Service Ratio Explanation And Examples With Excel Template

Debt Coverage Ratio Example And Importance Of Debt Coverage Ratio

10 Best Installment Loans Online For Bad Credit With No Credit Check

How Much Should You Save By Age 30 40 50 Or 60 Financial Samurai

Total Debt Service Ratio Explanation And Examples With Excel Template

How Much Savings Should I Have Accumulated By Age

How Much Should You Save By Age 30 40 50 Or 60 Financial Samurai

Who Has Student Loan Debt In America The Washington Post

How Much Townhouse Can I Afford Deals 54 Off Powerofdance Com

Debt To Income Ratio Formula Calculator Excel Template